Carbon Trading & Carbon Offsets

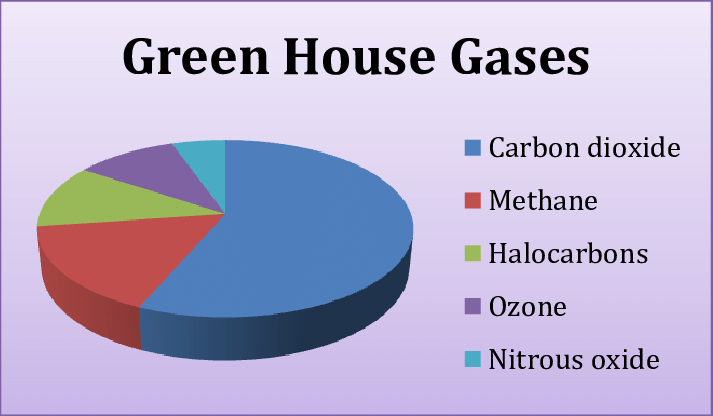

The International Panel on Climate Change (IPCC) has called for the need to reduce greenhouse gas emissions by 2050 to help combat adverse climate change effects. The international body advises on the need to limit the global temperatures to 1.5 degrees with the aim of reducing the impacts of climate change. With this in mind, companies, industries, countries and individuals have a role to play in decarbonising the atmosphere.

The need to decarbonize the atmosphere bore the need of carbon markets and carbon financing schemes. In the carbon markets, traders trade through carbon credits. It provided a platform for companies and businesses to buy or exchange carbon credits with the aim of reducing carbon in the atmosphere, enhancing livelihoods of the communities and ultimately protecting the globe from climate change effects.

Carbon credits were introduced by the UN as a market mechanism to allow companies and industries willing to offset emission, purchase credits from companies or projects that avoid emissions or capture carbon. It is noted that some emissions are unavoidable and purchasing carbon credits from carbon reducing projects elsewhere evens out the emissions and also helps finance the projects

Carbon credits are measurable, verifiable emission reductions retrieved from projects that reduce, remove or avoid greenhouse gas emissions to the atmosphere. The projects also protect and empower communities through improvement of their livelihoods and also conserve and protect ecosystems through restoration and protection of forests for example. Verification of projects is done by various agencies and reviewed by experts through carbon offset standards such as Verra and Gold Standard or standards verified by UNFCC.

In order to earn carbon credits, projects need to prove beyond reasonable doubt that were it not for the project, carbon would have been released to the atmosphere. Reduction in emissions achieved by any climate action project would not have happened if the project was not implemented. This aspect, commonly referred to as additionality, is important for any project seeking to gain carbon credits.

Carbon offsetting projects can be located anywhere in the world. Companies for example in Europe or United State can invest in projects in Africa that aim at offsetting or reducing carbon in the atmosphere. This is because, the rising CO2 levels in the atmosphere is a global problem and the changes affect every individual and country in the globe. The atmosphere is shared amongst all nations and hence it does not matter where the project is located.

Companies are moving towards net zero targets through carbon credits. This means, companies have a commitment to maintain zero GHG emissions balance. It can be done through reducing direct emissions within the value chain of financing emission reduction and removal projects. Projects that gain carbon credits can be categorised as projects that avoid emissions, remove or reduce emissions and captures and destroys GHG emissions.

Projects that avoid emissions mainly involves changes in operations along the value chain in companies. This may include using renewable energy sources as opposed to the fossil- fuel. Removing or reducing emissions projects are mainly offshore. This may include projects whose main role is to plant trees and conserve forests. Capturing and destroying emissions can include projects such as methane gas capture from wastewater.

Carbon trading and carbon markets are gaining popularity as most individuals and companies become cognisant of the need to reduce the global temperatures. The markets provide a platform to compensate companies and individuals who undertake projects that reduce, removes and destroys emissions in the atmosphere. On the other hand, it offers an avenue for companies that can not avoid emission in their line of operation to finance projects that reduces emissions.

I was very pleased to uncover this site. I wanted to thank you for ones time for this particularly wonderful read!! I definitely liked every bit of it and I have you bookmarked to see new stuff on your blog.