Any Potential for Carbon-Based Trading To Go Mainstrean?

For almost a decade now, the issue of carbon trading has been making subtle waves in the sustainability agenda, but recently it is gaining momentum globally. Large companies are now staking a claim in the purchase of carbon credits as a means of investing in natural carbon sinks. Since more enterprises are aware of the impact of climate change on the globe, the need to contribute to a sustainable future is pushing the voluntary carbon trading agenda and this therefore means that carbon trading will soon go main-stream.

According to a market survey by Natwests markets, nearly 640 billion USD has been invested in climate finance .As more companies are buying into the carbon credits, the demand for carbon offsets could outrun the supply by 2025 which means that the prices of carbon credits may see a steep rise by 2030, with the carbon offsets being valued at between 125 to 150 billion dollars by year 2050.

Carbon financing plays a huge role in the conservation of nature and the protection of forests which are facing major threats from human driven destructions. The funds that are acquired from carbon financing ensure that there is adequate monitoring and policing of the natural reserves. Since most investors are mainly risk averse, more needs to be done to ensure that the issue of climate change and biodiversity loss crisis is addressed and this may mean embracing more sustainable models especially in the agriculture and forestry sector which are the major areas that can result in huge changes in the sustainability agenda. Some of the recommended sustainability models in agriculture include, no till agriculture, agro forestry and social forestry.

For the farming communities living near forests and other nature reserves, carbon trading can be a source of income to the farmers, who mostly rely on the forest for their livelihoods. By financing sustainable agricultural activities, the carbon financing will play a huge role in minimizing or completely eradicating the drivers of deforestation and nature degradation and this is by providing alternative income generating activities to the farmers and promoting sustainable agriculture.

A lot of questions may arise as to the validity of the options provided for climate finance because let’s face it, the issue of carbon trading has been discussed for a long time with no tangible solution in sight and stakeholders may begin to wonder what makes it different now than before. Despite the hurdles that carbon trading schemes may have to undergo, it is high time that all the stakeholders across the globe come together to agree on the best way to move when it comes to the issue of carbon trading as a means of sustainable growth .

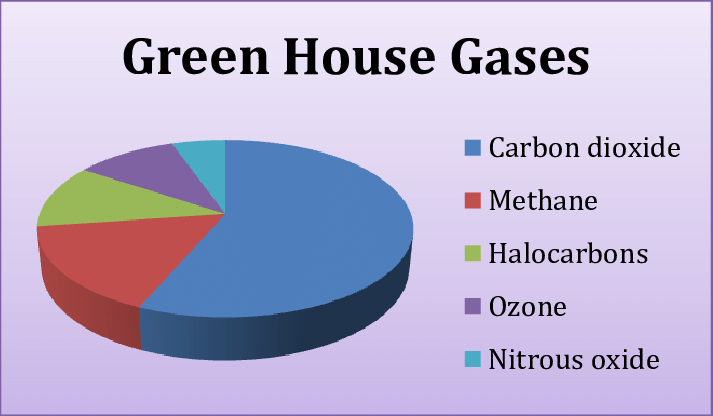

To understand the issues around carbon finance and trading, we must first understand the concept. Carbon trading can be defined as the buying or selling of carbon credits to finance the removal of greenhouse gases from the atmosphere. A company may choose to offset its carbon emissions by supporting projects that promote tree planting activities or provision of cooking stoves as an alternative to fuel wood .After they offset their emissions, the companies may choose to sell their unused credits. In simple terms carbon trading is the balancing off of the GHG emissions produced Vis a Vis the emissions offset.

The major hurdle that has been facing carbon trading is the payment procedure for the carbon projects. In one instance the Indonesian government took part in the REDD+ project from early 2000s and developed projects that reduced emissions from deforestation and forest degradation.However, the money to support the projects was available but it did not reach the developers soon enough and this discouraged other project developers from engaging in such projects.

Another issue to be dealt with is that of land ownership and land rights. Most of the projects undertaken to offset GHG emissions need huge pieces of land .This land ,mostly belongs to individuals who may have a totally different objective on how to use their land and therefore convincing them to get involved in carbon offsetting projects may be quite difficult. Due to this challenge, companies are usually advised to find ways to reduce their emissions and use carbon trading as the last resort. The land owners will also need to be convinced that carbon trading is a worthy investment, for them to be able to use their land for carbon projects.

The final and major challenge in carbon trading is land-use practices. Most farmers are not aware that some of the “normal” practices may result to a high chunk of greenhouse gas emissions. Practices such as crop production, agrochemical use, and livestock farming are among the major threats to sustainability especially in developing worlds. The solution to these challenges lies in the use of innovative and sustainable farm practices and livestock intensification programs to prevent encroachment especially in forest areas.

For every dark tunnel, there has to be some light in sight and in the case of carbon trading some hurdles may be crossed through various alternatives. First, companies need to include in-setting in their supply chains which involves including carbon offsetting initiatives in their operations. Another solution can be to include specialized carbon financing to promote carbon offsetting projects by both private and government institutions.

We might try and find various solutions to the hurdles that are being faced in the sustainability issue but the major key to solving the challenges faced is to provide a win-win situation where parties involved in the sustainability projects feel like they are getting a fair share of the profits from the programs. Carbon trading will for sure reduce the risks involved in investing in carbon offsetting projects but the responsibility of fulfilling the sustainable development goals lies on each and every one of us. No matter how slow the process has been, the world is beginning to accept that maybe carbon trading is a sure way to achieve the sustainability agenda.

I was very pleased to uncover this site. I wanted to thank you for ones time for this particularly wonderful read!! I definitely liked every bit of it and I have you bookmarked to see new stuff on your blog.